Your AI Powered Assistant for UK Accounting

Your assistant for UK tax and accounting queries. Purpose-built for accountants who need reliable guidance, fast.

Your assistant for UK tax and accounting queries. Purpose-built for accountants who need reliable guidance, fast.

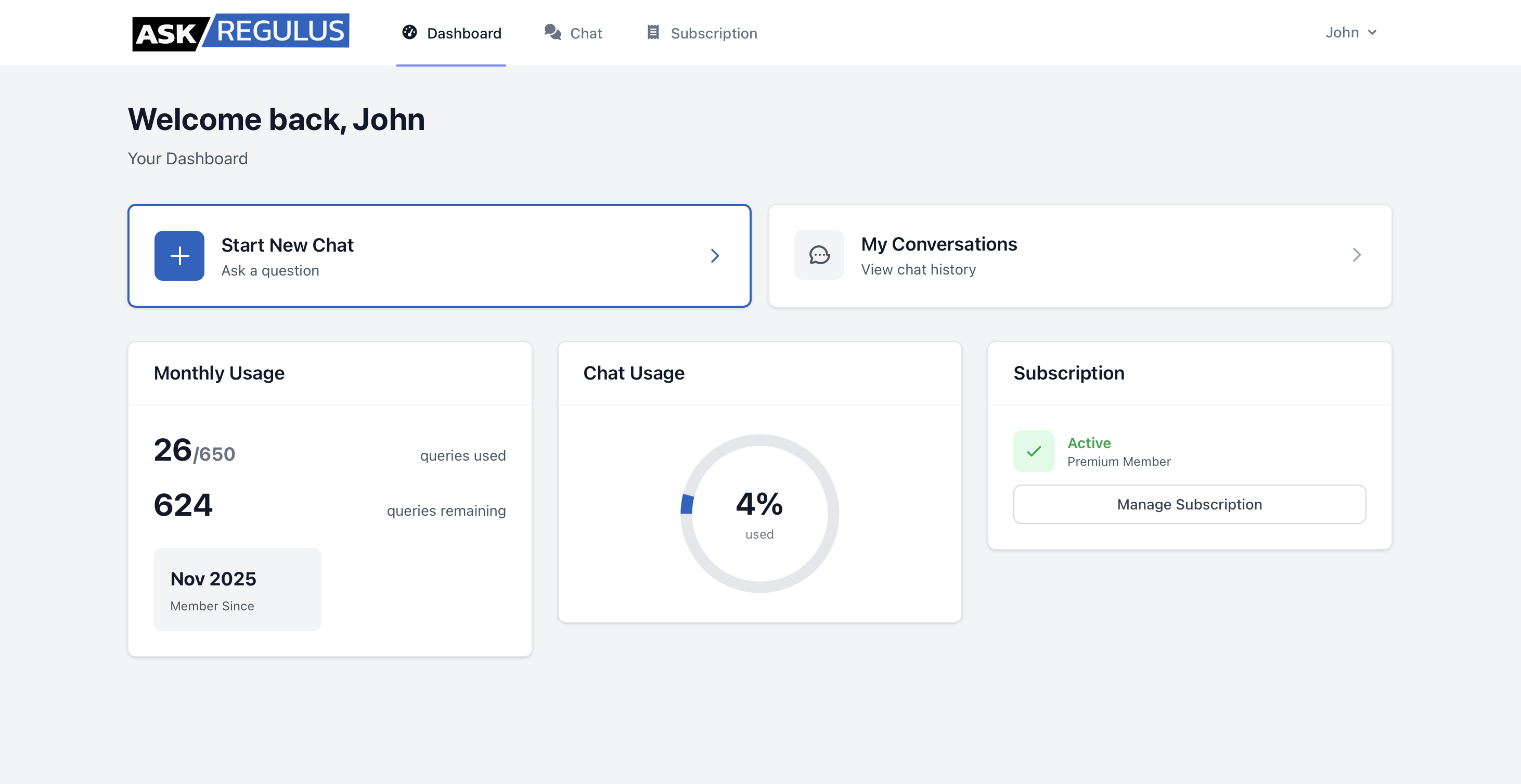

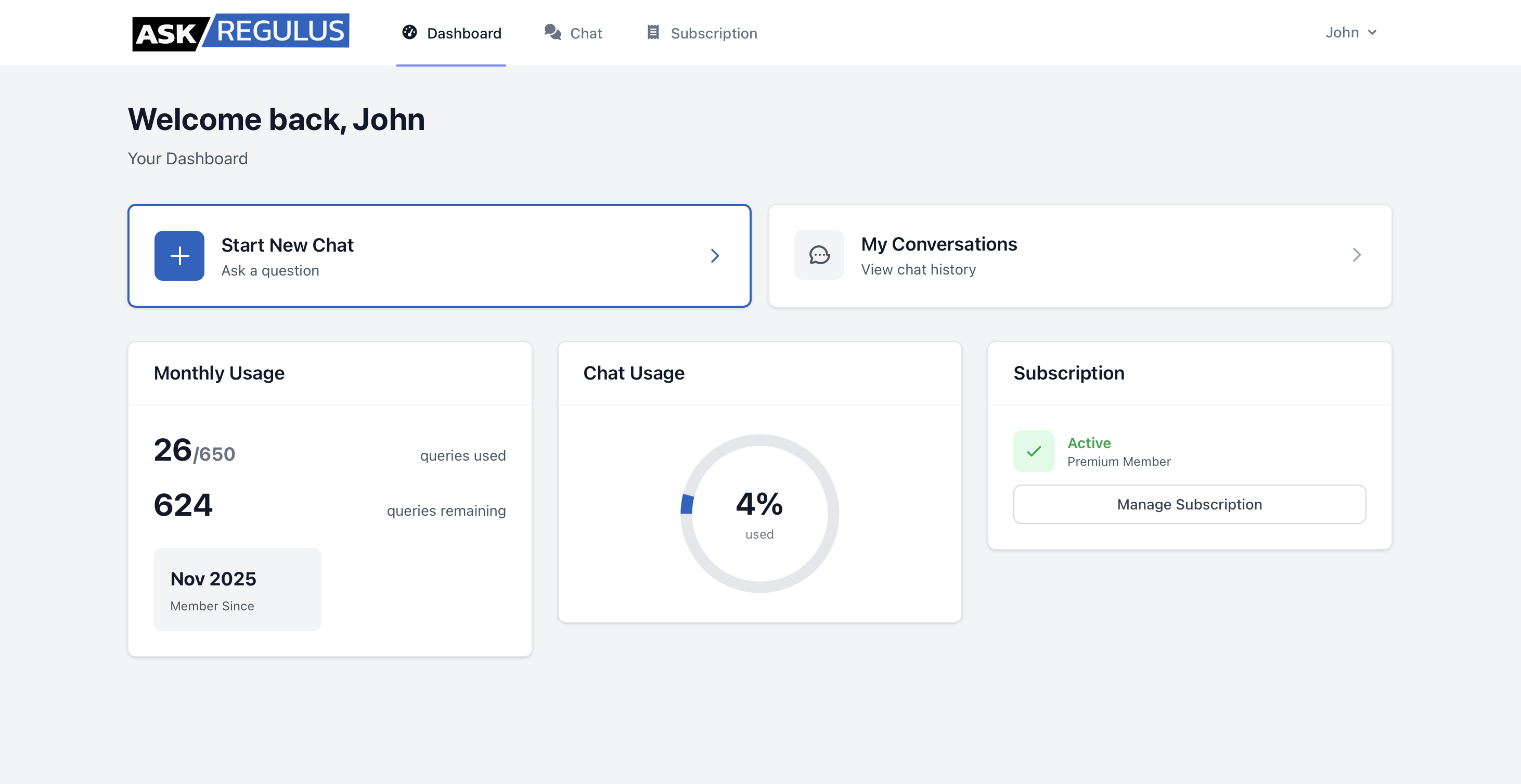

Track your usage, manage conversations, and stay on top of your accounting practice with an intuitive dashboard designed for professionals.

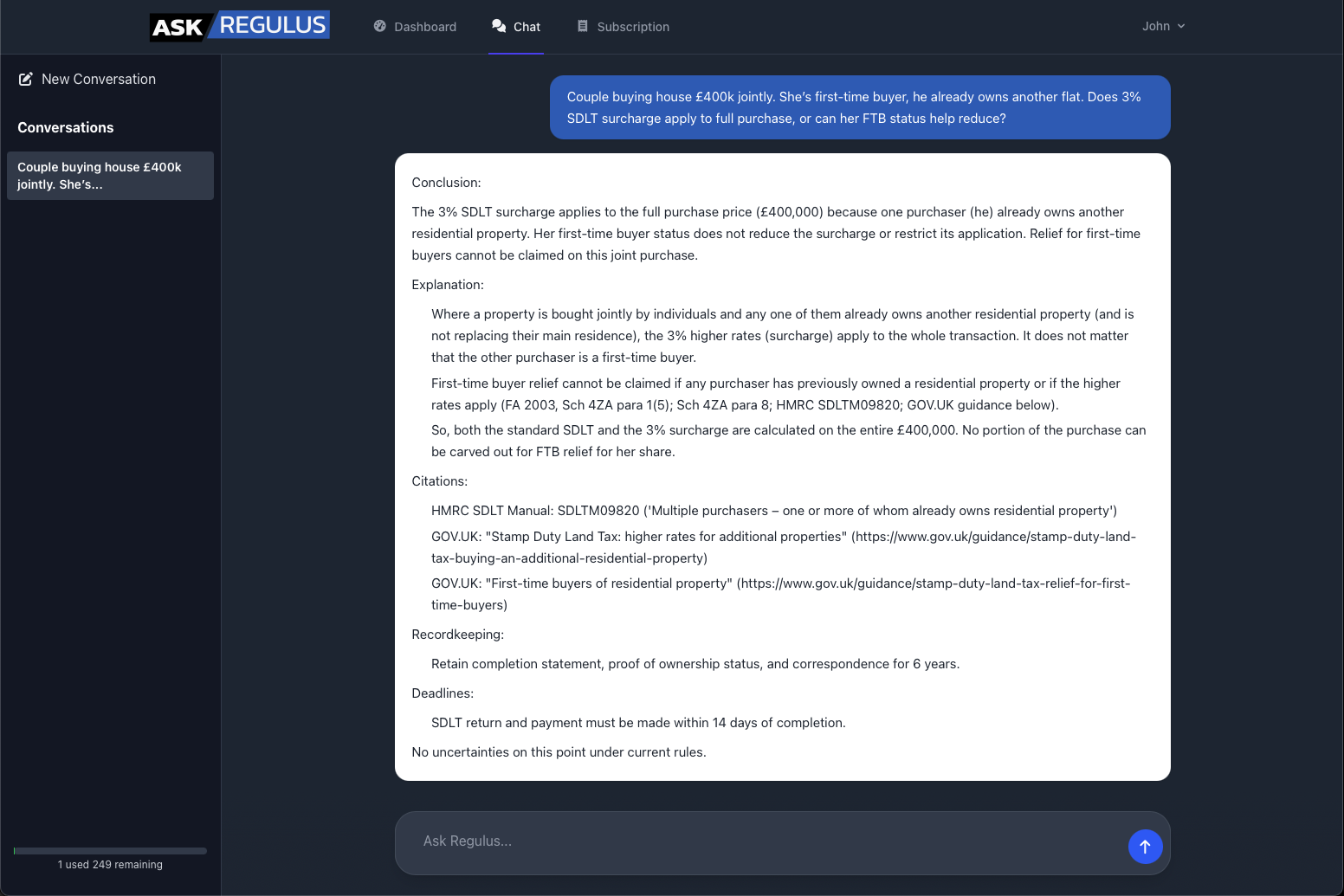

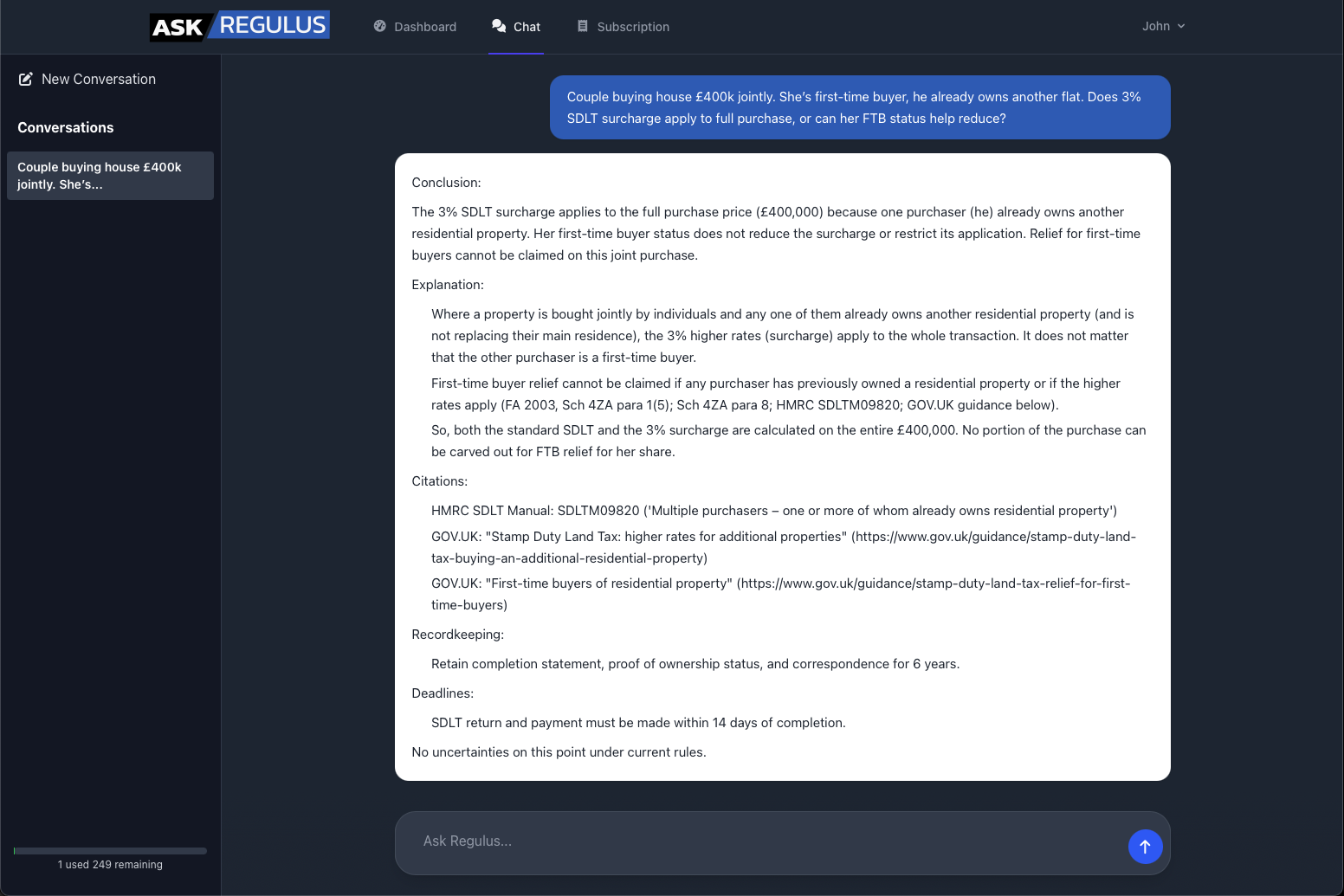

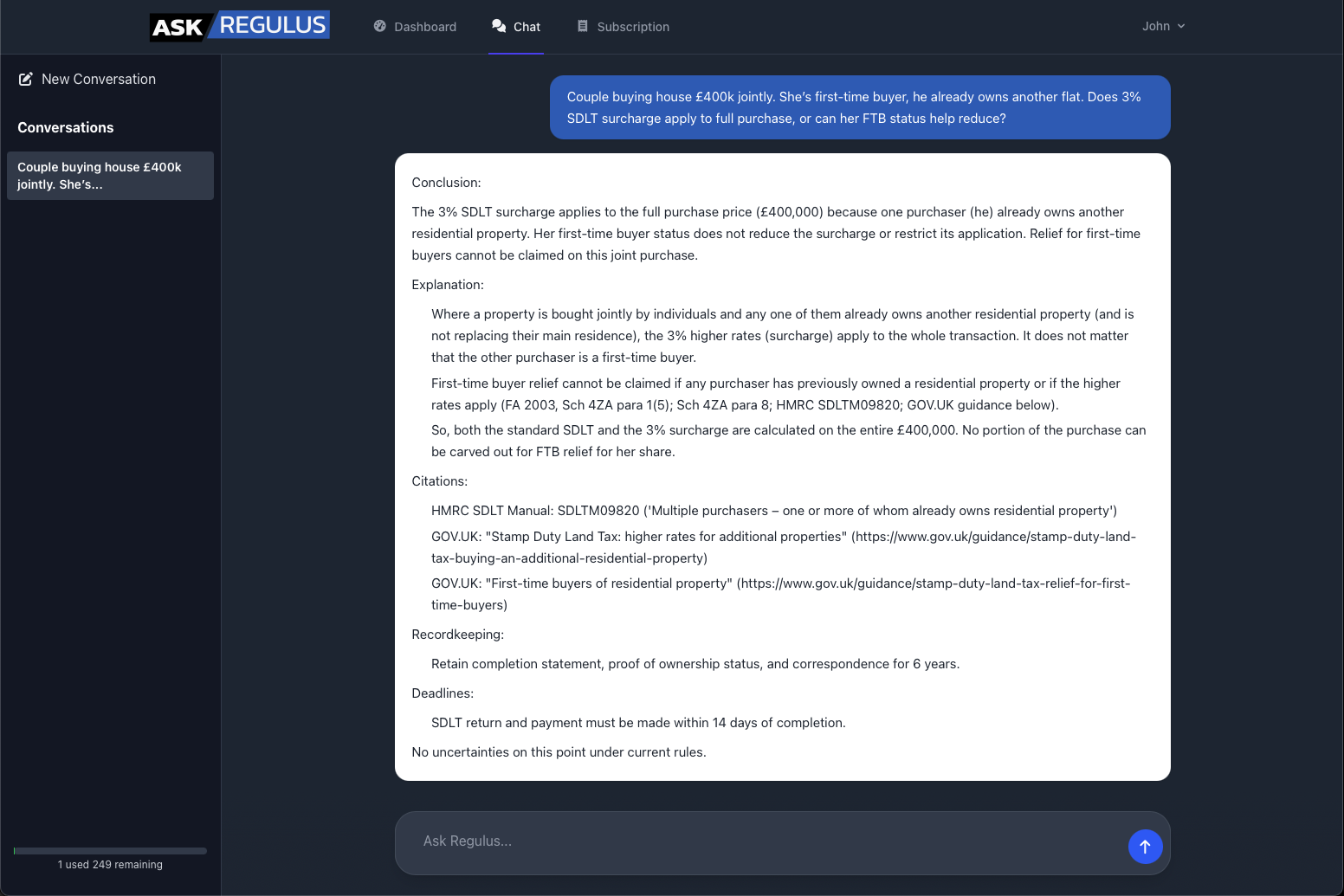

From complex capital gains calculations to VAT queries, get rapid answers tailored to UK accounting standards.

Get detailed explanations with relevant legislation references, calculation examples, and practical guidance you can apply immediately.

Everything you need to streamline your accounting practice

Designed to provide guidance on UK tax law, HMRC guidelines, and FRS 102 accounting standards.

Your client data stays confidential. We don't train on your queries and meet GDPR compliance.

Get answers in seconds, not hours. No more digging through manuals or waiting for callbacks.

Export conversations as PDFs, CSVs, or formatted memos ready to share with clients.

Provide consistent tax guidance to support your team with reliable UK tax information.

Regular updates with latest tax changes, case law, and HMRC guidance.

Three simple steps to better accounting

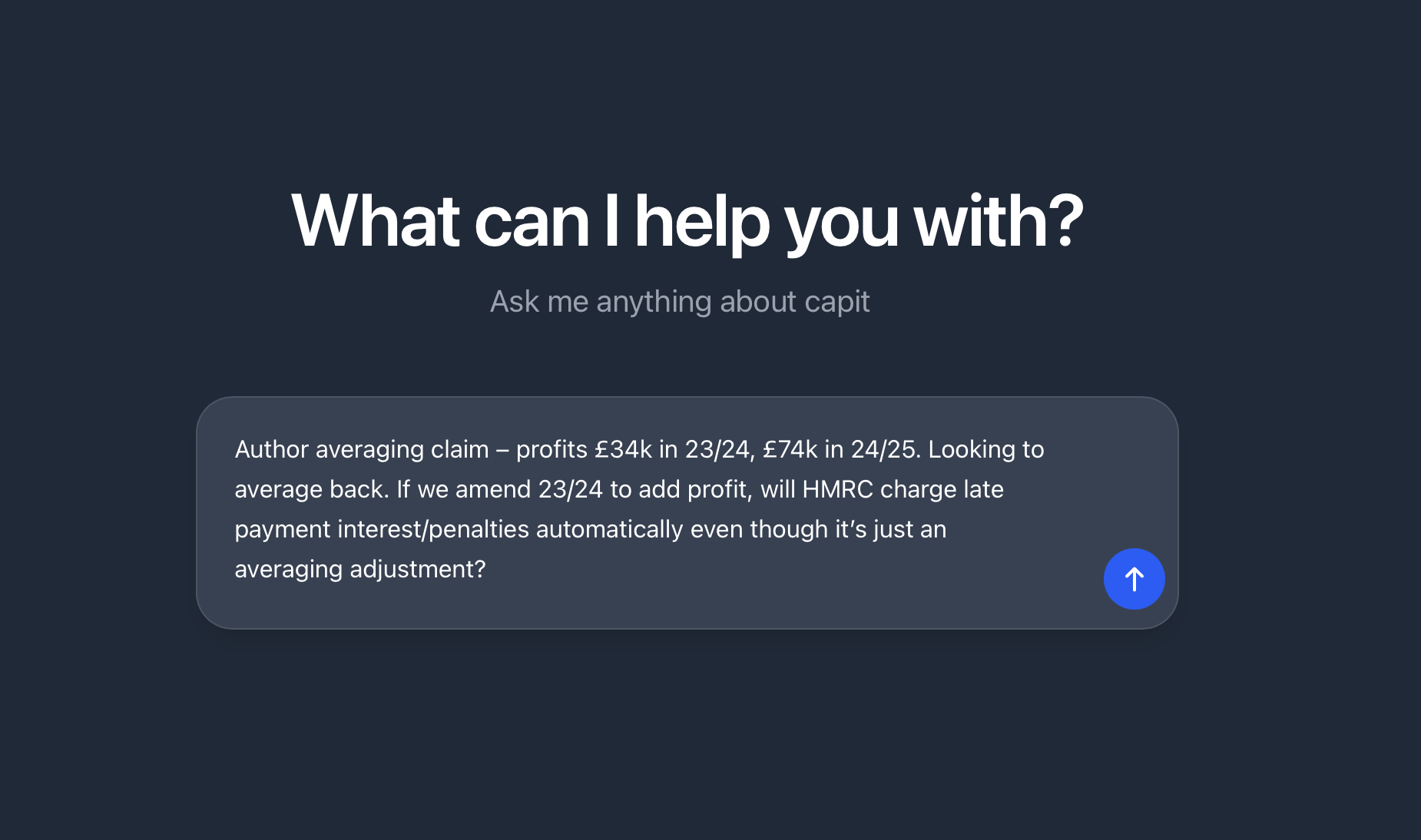

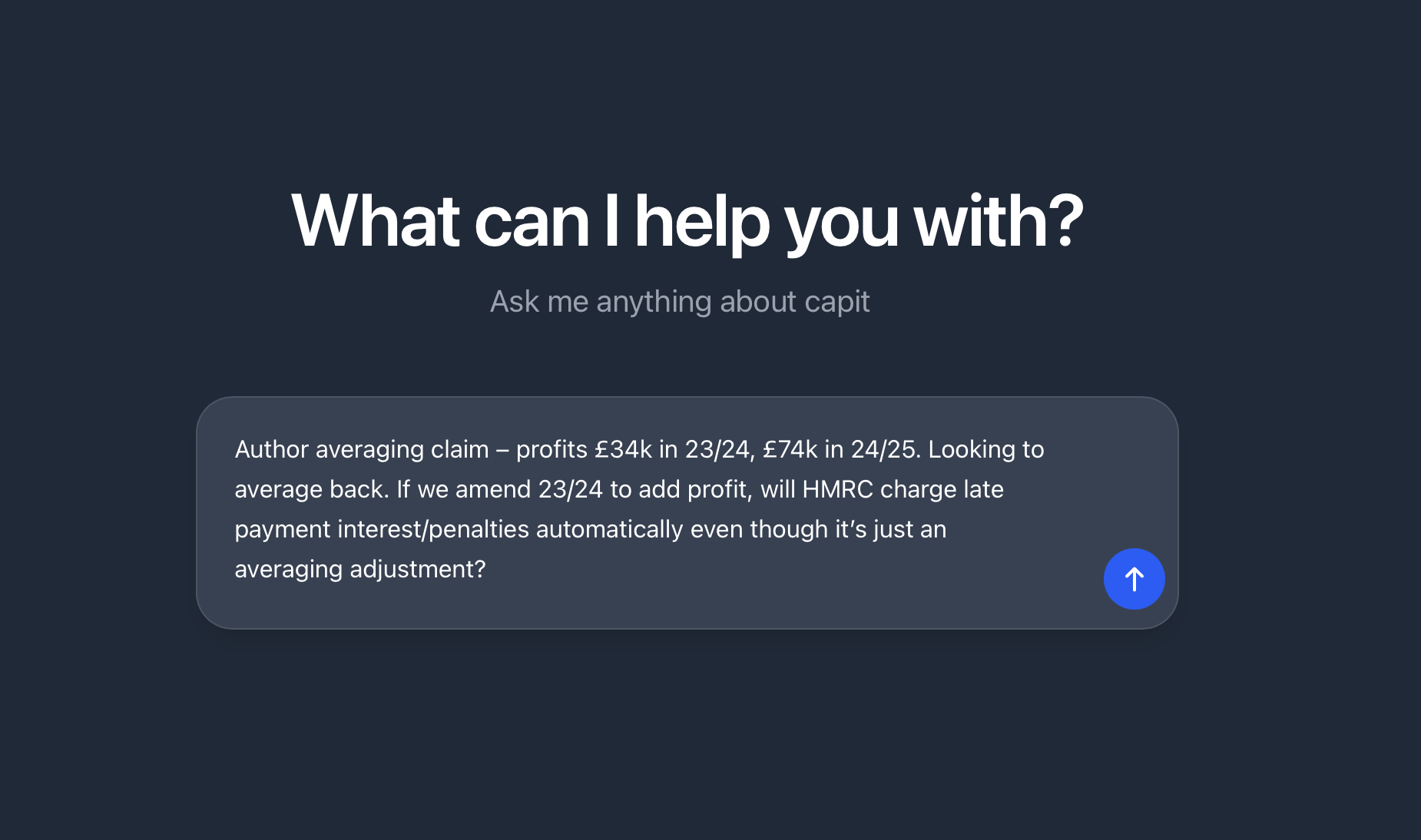

Type your UK tax or accounting query in plain English. No technical jargon required.

Receive rapid, detailed responses based on current UK regulations and best practices.

Download formatted responses or share directly with clients and team members.

Choose the plan that works for you. Cancel anytime.

Perfect for solo accountants

For busy accounting professionals

For growing accounting firms

Looking for more?

A customised plan for your practice is just an email away. Contact us

Get ahead of the curve, join the accountants who are saving hours every week with Regulus.

Cancel anytime.

Terms apply. Learn moreEverything you need to know about Regulus

Ask us anything!

Hi! 👋 I'm here to help with questions about Regulus, pricing, your account, and more. What can I help you with?

Or email support@askregulus.com